When you run a business in Malaysia, payroll is one of those tasks that can either run smoothly in the background or turn into a never-ending headache. Between salary calculations, tax deductions, statutory contributions, and now the push towards e-invoicing, many companies are realising that their traditional ways of managing payroll simply aren’t enough anymore.

That’s where modern payroll software steps in—not just to automate the nitty-gritty of salary disbursements, but also to keep businesses aligned with evolving requirements from the Inland Revenue Board of Malaysia (IRBM). And with e-invoicing becoming mandatory in phases, having payroll software that integrates seamlessly with e-invoice systems is fast becoming a necessity.

Why IRBM Compliance Is Suddenly Everyone’s Priority

If you’ve been keeping an eye on the news, you’ll know that IRBM has rolled out a phased approach to mandatory e-invoicing. Big companies were the first to be affected in 2024, and by July 2025, all businesses, including SMEs and microenterprises, will need to comply.

What this means in practice is that every transaction, including salary-related disbursements that qualify under the e-invoice scope, will need to be reported electronically to IRBM. This helps the government close tax gaps, improve transparency, and ensure a more efficient digital tax ecosystem.

For employers, though, it translates into an urgent need to ensure their payroll systems can connect to e-invoicing infrastructure. Without that integration, you risk delays, manual errors, or worse—non-compliance penalties.

The Traditional Payroll Pain Points

Payroll has always been a complex area for Malaysian employers, and the shift towards e-invoicing just adds another layer of complexity.

Here are some of the challenges businesses often face with older or manual payroll systems:

- Cumbersome tax reporting – Employers often struggle to keep track of monthly deductions and yearly reporting for IRBM.

- EPF, SOCSO, and EIS calculations – Contributions must be calculated accurately and submitted on time, and errors can easily lead to penalties.

- Manual disbursements – Salary payments made without automation risk being delayed or incorrect.

- Lack of transparency – Employees expect payslips and tax deductions to be clear and accurate, which is difficult to achieve with manual systems.

With e-invoicing entering the picture, the stakes are even higher. A missed submission or incorrect e-invoice could result in compliance issues that businesses cannot afford to take lightly.

How Payroll Software with E-Invoice Integration Helps

Modern payroll software like Million is designed not just to calculate salaries and generate payslips but also to integrate with Malaysia’s e-invoice ecosystem.

Here’s how that benefits businesses:

1. Automated Salary Calculations

No more hours spent manually crunching numbers. Payroll software automatically calculates gross pay, deductions, and net salaries, ensuring accuracy every month.

2. Direct Integration with E-Invoicing Systems

Payroll systems that are IRBM-compliant can connect directly to the MyInvois Portal or via approved APIs. This means payroll-related invoices and relevant reports can be generated and submitted without manual uploads.

3. Real-Time Compliance Checks

The software ensures that data formats and reporting structures match IRBM’s requirements, reducing the risk of rejected submissions.

4. Seamless Record Keeping

Every transaction, from salary disbursement to tax deduction, is recorded digitally and stored securely, making audits much easier to handle.

5. Time and Cost Savings

Automating payroll and e-invoicing together means fewer resources spent on administrative tasks, freeing up time for HR and finance teams to focus on strategy instead of paperwork.

Features to Look Out for in E-Invoice-Ready Payroll Software

Not all payroll systems are created equal, and with e-invoicing becoming mandatory, businesses need to be selective when choosing a solution. Here are some key features to consider:

- IRBM Certification or Readiness – Make sure the software is recognised as compliant or actively updated to match IRBM’s latest requirements.

- API Connectivity – Direct integration with the MyInvois Portal is crucial for efficiency.

- Multi-Statutory Compliance – The system should automatically handle EPF, SOCSO, and EIS alongside tax.

- Customisable Reporting – Employers should be able to generate and customise reports for both compliance and internal use.

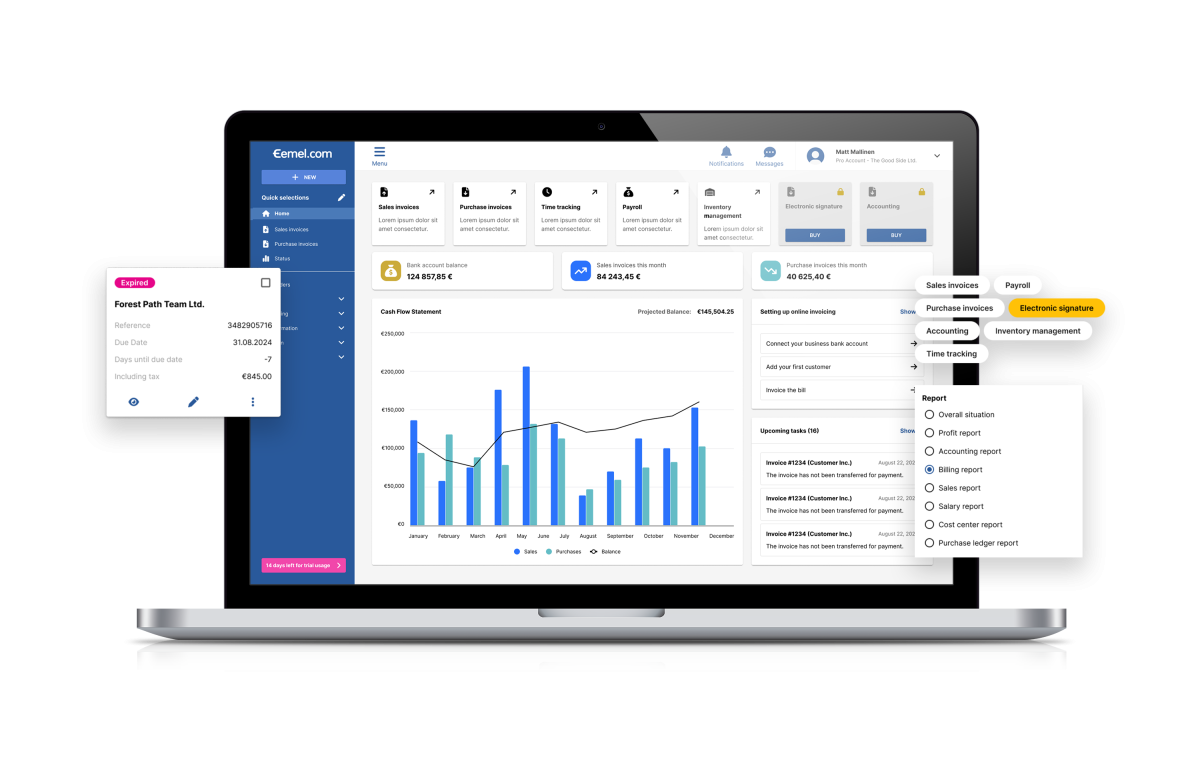

- User-Friendly Interface – HR teams don’t want complicated systems. A clean, intuitive interface makes a huge difference.

- Scalability – As your business grows, your payroll software should be able to keep up without requiring a complete overhaul.

Why This Matters for SMEs in Particular

Large corporations often have the resources to deploy custom ERP solutions with in-house compliance teams. SMEs, on the other hand, typically rely on lean HR departments or even a single staff member to handle payroll.

For these businesses, payroll software that comes with built-in e-invoicing capabilities can be a game-changer. It reduces the manual workload, cuts down on compliance risks, and ensures they can keep pace with regulatory requirements without having to hire additional staff.

Think of it as levelling the playing field. With the right payroll solution, even small businesses can stay compliant and professional in their operations.

The Future of Payroll and E-Invoicing in Malaysia

Looking ahead, the integration between payroll systems and e-invoicing is likely to become even tighter. Beyond compliance, businesses can expect to see more data-driven insights from these tools. For example, payroll data could be used to forecast cash flow, manage workforce costs more effectively, or even support employee financial wellness programmes.

The key takeaway is that compliance is only the starting point. The true value of payroll software lies in how it can transform HR and finance operations into something more strategic, efficient, and employee-focused.

Final Thoughts

E-invoicing is not just a box to tick for IRBM compliance—it’s part of Malaysia’s broader shift towards a fully digital economy. For businesses, this means adapting now rather than scrambling later.

Payroll software that supports e-invoice integration offers the best of both worlds: ensuring compliance while streamlining salary disbursements and improving overall efficiency. Whether you’re a large enterprise or a growing SME, the right system will help you stay ahead of regulatory changes while giving your employees the timely and accurate payroll experience they deserve.

So, if your business hasn’t already started reviewing its payroll processes, now is the time. Choosing the right payroll software could be the difference between staying compliant with ease and struggling to keep up with IRBM’s digital shift.